TSG and ETA highlight game-changing opportunities for SaaS providers

A Game-Winning Play

Software and payments have proven to be a winning combination. At an increasing rate, SaaS companies, often known as independent software vendors (ISVs) are starting to bring financial services into their ecosystems. One significant aspect is taking the electronic payments their downstream merchant customers generated and integrating these transactions into their systems. This creates value to their customers by giving them an increasingly “one-stop-shop” for their business, unified reporting, and various data-related benefits. At the same time, ISVs are turning this payment processing volume into meaningful revenue figures, resulting in higher profitability and valuations. TSG has seen ISVs making ten times more revenue by monetizing the payment processing volume their systems support than they were earning on software license fees alone. Talk about a win-win scenario.

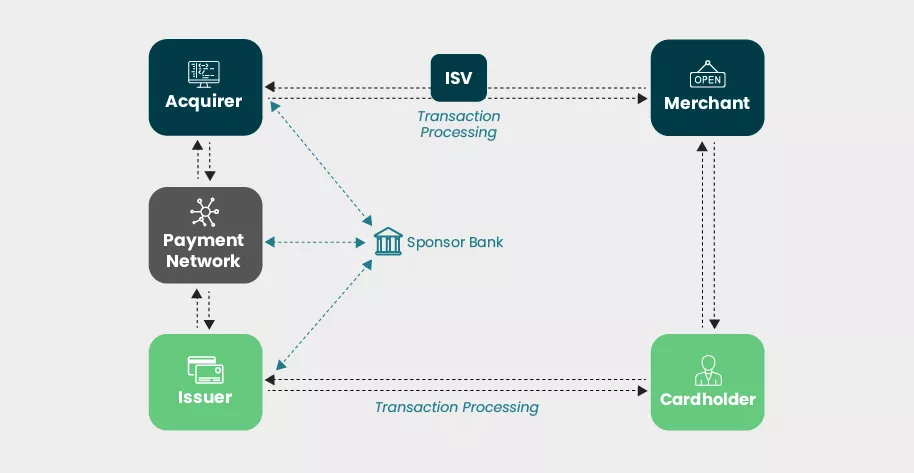

ISVs are a key component in the modern payment transaction flow, as described in the following chart. This chart is a generalized list of players that support a typical card-based payment authorization, though there are many other supporting players involved in this process that are not shown. Other payment methods, such as cryptocurrency, real-time payments, and others have different flows.

Keep reading for options ISVs may want to consider, as well as a brief overview of monetization models to create new revenue streams. Stay tuned for more ISV-focused insights and education from TSG and the Electronic Transactions Association (ETA), the global trade association of the payments technology industry.

Options Abound for ISVs

As it relates to connecting financial services and monetizing them in an ISV’s ecosystem, the options for ISVs are abundant. Many of these options fit under three categories:

- Services ISVs can Offer to their Customers

- Models ISVs can Adopt to Monetize Payments

- Partners ISVs can Work with to Support their Payment Operations

Services ISVs can Offer to their Customers

With the proliferation of open APIs, cloud deployments, and general market movements towards electronic payments, the barriers to monetizing payments have never been lower for ISVs to get in the payments game.

A pillar of these options is electronic payment processing. In today’s environment, ISVs can give their merchant customers the ability to accept downstream payments from their customers across a variety of payment methods. From credit and debit cards, buy now, pay later services, cryptocurrency, ‘peer-to-peer’ apps like Venmo and bank account transfers, the more options accepted give more avenues to take in revenue. ISVs can provide their customers with transaction processing services, including payment acceptance, payment hardware, fraud solutions, and more. The merchants that ISVs support run thousands of payments that an ISV can monetize; hence the economies of scale that the payments industry brings are lucrative.

Additionally, regulatory shifts and market trends are opening the door to opportunities in embedded finance. This term broadly refers to the inclusion of financial-related services into the offerings of a company that is not traditionally a financial services provider. Financial services can vary from loans, insurance, checking accounts, credit card accounts, and more. With the layered technology infrastructure ISVs bring to the table, they can offer various financial services into their systems via a ‘tech-touch’ approach.

Here’s a hypothetical example; an ISV that serves construction merchants learns that these types of merchants generally have a variety of insurance needs. The ISV decides to partner with an insurance provider to support a new insurance program within the ISV. Since the ISV has profile information on its customers, it can push personalized insurance notifications to customers and fulfill onboarding to the insurance program in a highly digital manner. The ISV’s customers benefit by gaining access to a helpful new service from a source they already work with. The ISV gains another inroad into customers that adopt the service, which may promote a longer-term customer relationship. The ISV also gains additional revenue that it receives from the insurance provider for bringing them new business.

Clearly, a layer of technology powers merchants’ business operations. The market going forward is technology-enabled, allowing integrated financial services with flexibility and less friction. Software is a major driving force behind commerce, and it will determine who merchants work with, how they run their businesses, and where they find service providers.

Models ISVs can Adopt to Monetize Payments

Another area that ISVs have options in is the structural models they can leverage to create revenue from payment processing activities. ISVS must understand their options in assessing which payment monetization model works best for them.

In doing so, the ISV may sell, manage, support, and in some situations, underwrite merchants for payment processing. By taking on these additional roles, traditionally fulfilled by a dedicated payment service provider, an ISV may receive a commission or a percentage cut of the payment volume they help to facilitate.

Traditionally, ISVs have accomplished payment monetization through four generalized models:

- Referral model

- Payment facilitator

- Retail ISO

- Wholesale ISO

Each model is nuanced and comes with its own requirements and regulations, and each comes with a different level of risk vs. reward. The varying levels of risk and operational resources an ISV is willing to dedicate generally dictate the revenue split an ISV will receive, in addition to other factors such as how much payment processing volume the ISV is generating from its merchant base.

This makes education on the payments industry and its players critical in developing a payments strategy.

Simple referral models generally afford the ISV little to no liability for the payment transactions their customer base generates, but it also gives the ISV little control and generally less revenue than other models.

Progressing into the payment facilitator model or the ISO (Independent Sales Organization) model brings additional risk and corresponding resource requirements for the ISV involving funding reserves, staff, etc., but also provides greater revenue splits with their payment partners. These models also give more control; for example, payment facilitators can “buy” transactions in bulk from their payment processing partner and price them to ‘sub-merchants’ using their discretion.

Monetizing payments can offer ISVs more significant revenue streams, the ability to control their customer experiences more, and ultimately drive the valuation of their business.

At the end of the day, there is no ‘one model fits all’ in payments monetization, but learning about what each model entails will help guide ISVs to a successful implementation. Each ISV must decide for themselves which model fits their future business goals.

Partners ISVs can Work with to Support their Payment Operations

There is no shortage of options for ISVs in terms of available payment service providers they can connect to. While true processing technology is held by a limited number of major payment processing entities, there are numerous service providers in the payments ecosystem that support ISVs in their payment and embedded finance monetization endeavors. The ETA community is a great place for ISVs to personally connect with these players and get to know their options better. In fact, ETA’s signature event, TRANSACT, taking place April 24-26 in Atlanta is the perfect opportunity to meet prospective partners and increase education on the payments space.

ISVs may work with one payment processing partner or a set of partners. They often leverage more than one payment processing partner for various reasons, such as the diversity of their client base, geographic coverage, etc. Driving factors in partner selection range from revenue sharing terms, level of seamless onboarding, access to innovative technology, quality of support, and more.

In a recent survey of ISVs conducted by TSG, ease of implementation was in the top three reasons ISVs chose to work with their preferred payment processing partner (it is good for payment processing providers to gather feedback from the ISV community to benefit all involved). This could point to the importance of payments players having a ‘like-mindedness’ with tech-smart ISVs that often provide seamless technology-driven experiences to their customers. They may also expect this type of experience from their payment processing partners.

It is ideal for an ISV to research and get to know prospective payment processing partners that may end up supporting the largest driver of revenue the ISV generates, given the inherent attractiveness of electronic payment processing.

ISVs can determine if they want to be supported by a large in-house payment processor, a more localized merchant acquirer, a pure payment gateway provider, a ‘payfac as a service’ provider, etc. as they all have their separate value propositions.

Since many ISVs serve specific vertical markets in the merchant community, finding a payment processing partner that understands the unique needs of those merchant markets should also be a consideration. Does the payment provider speak the language of the industry the ISV serves? That can go a long way if so.

Examples

TSG supported an ISV serving the manufacturing industry that was seeking to streamline payments acceptance and drive additional revenue. The company launched as a payment facilitator, and as a result of its payments monetization efforts, the ISV generates about $200 million annually in new payment volume that had not been digital before. The ISV’s merchant acquirer provided a transaction ‘buy rate’ of 0.04% and $0.06 per transaction. The ISV set the processing rate for its sub-merchant customers and keeps 100% of the buy rate. As a result, $1.7 million in new annual revenue was created for the ISV.

Another ISV TSG supported had no experience in payment processing, but through monetization efforts was able to produce revenue in under 12 months. Through payment processing and increased adoption and tenure of its existing customers, the ISV now has recurring revenue in excess of $10 million.

Final Play

Payment processing and embedded finance opportunities are game-changing areas for ISVs. ISVs need to formulate a strategy to move into these areas by determining the desired level of resources to allocate, risk appetite, and the right partner for their unique situation.

If you’re in the ISV game, head to ETA’s 2023 TRANSACT to learn about payments, connect with prospective partners, collaborate with peers, and meet people who can drive your business to the next level.