Industry Focus of PSPs Influences Individual Performance

By Jeff Fortney, TSG Senior Associate

2008: The Great Recession

In 2008, the U.S. economy learned a new word: derivatives. A simple word defining an investment type that resulted in many banks’ failures (or near failures) in the latter months of 2008. The subsequent period was known as the Great Recession. This came to mind with the S&P closing 2022 with the largest drop since 2008.

In 2008, the mainstream belief in the payments acceptance industry was that the recession would reduce card usage, resulting in reduced revenues for payments companies.

However, some believed that card usage and acceptance would grow. There would be reduced spending, but payments would be made more frequently with credit or debit cards. The only reduction would be found in cash and check usage.

Simply put, the payments industry would be more like industries that historically have been recession and inflation-proof. At the end of 2009, it did appear that this philosophy may be accurate. However, it was anecdotal at best.

Fifteen Years Later

Fifteen years after the Great Recession, this belief may have enough data to justify the premise that the payments industry is truly recession-proof.

First, a caveat: this is not to say that the economy is moving into a recessionary period. There are concerns about inflation, with efforts to address inflation potentially leading to a recession. Rather than reacting to these conditions, it is prudent to look backward first. Remember this simple saying, “He who does not learn from history is doomed to repeat it.”

Historically, the consumer reacts to market swings with common approaches:

- Lower savings balance

- Higher loan balances

- Forgoing monthly savings

- Spending on credit over debit

During a recessionary period, these approaches are very similar, with two additional results:

- Payment delinquencies

- Rise in Buy Now Pay Later

A key difference between historical swings and today is payment choices. Consumers use less cash and write fewer checks. Relatively few Millennials and Gen Zs even possess a checkbook. Their payment option of choice is a card, either credit or debit.

Diving Into the Data

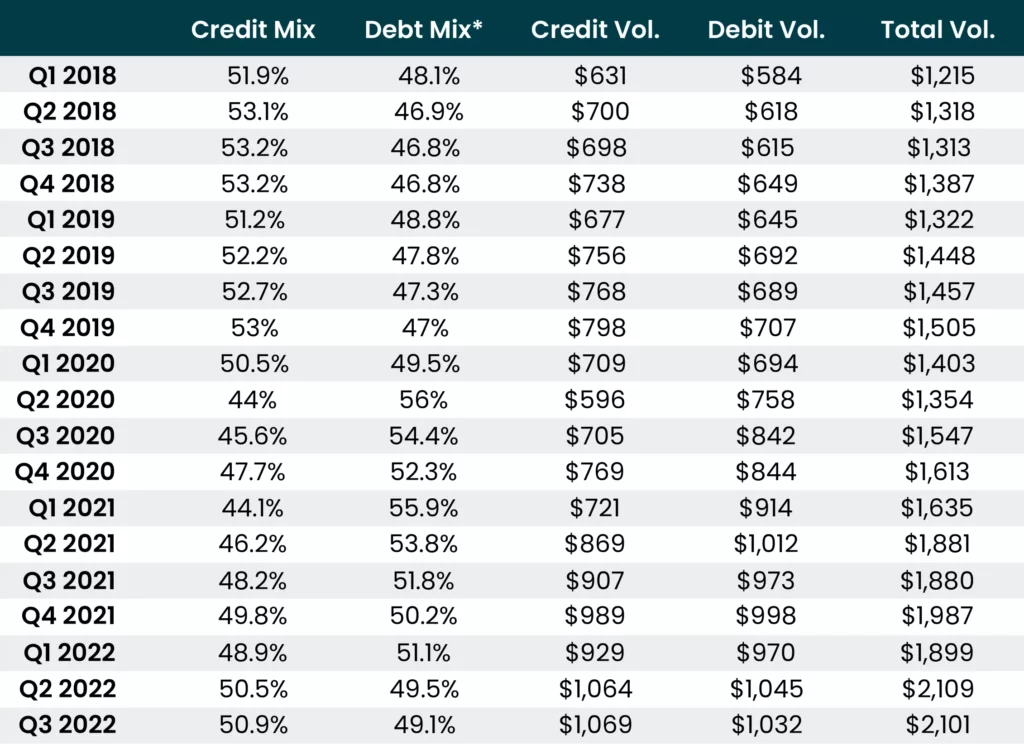

In either situation, the usage mix between debit and credit may change, but the volume and transactional counts still demonstrate consistent growth year-over-year (YoY). Using data sourced from Visa and Mastercard’s quarterly results on payments volume, there is clear and consistent evidence of growth over the past 19 quarters, despite swings in card usage.

While the 2020 pandemic can’t be classified as recessionary or inflationary, it does illustrate how consumers react and pay during a period of uncertainty, and it paints a picture of the payments industry’s resilience.

In the first quarter of 2018, 51.9% of spending was credit, with a total volume of $1.215B. The first quarter of 2019 reflected 51.2% in credit with growth to $1.322B in volume. The volume grew 9% over that period. In the first quarter of 2020 (covering the initial phases of the pandemic, but before the lockdown) the credit volume remained consistent at 50.5%, and volume grew by 6.1%.

Then, in the second quarter of 2020 (the first fully locked down quarter), volume did drop by 3.45%, but by the end of the fourth quarter, card volume processed grew over 19%. The credit volume usage in the first quarter was 44% and had increased to 47% by the fourth quarter. Although the credit volume percentage usage didn’t exceed 50% until the second quarter of 2022, the volume YoY was 23%.

Although many were locked down throughout 2020 and into 2021, actual card usage grew over that period. The 2020 increase also reflected a rise of card-not-present (eCommerce) transactions. In any fashion, the card volume (with its concurrent increased card count usage growth) did not drop during the pandemic or a subsequent inflationary cycle.

*Debit includes Visa Interlink

Impact of Card Mix Change on PSPs/Merchant Acquirers

The recent uptick in credit spending mix impacts acquiring portfolio profitability. Acquirers that bill merchants with a bundled, tiered, or fixed fee previously benefited from the lower interchange cost on debit without the offset in revenue. With the reversal of credit & debit mix, blended margin compression is found with these billing types.

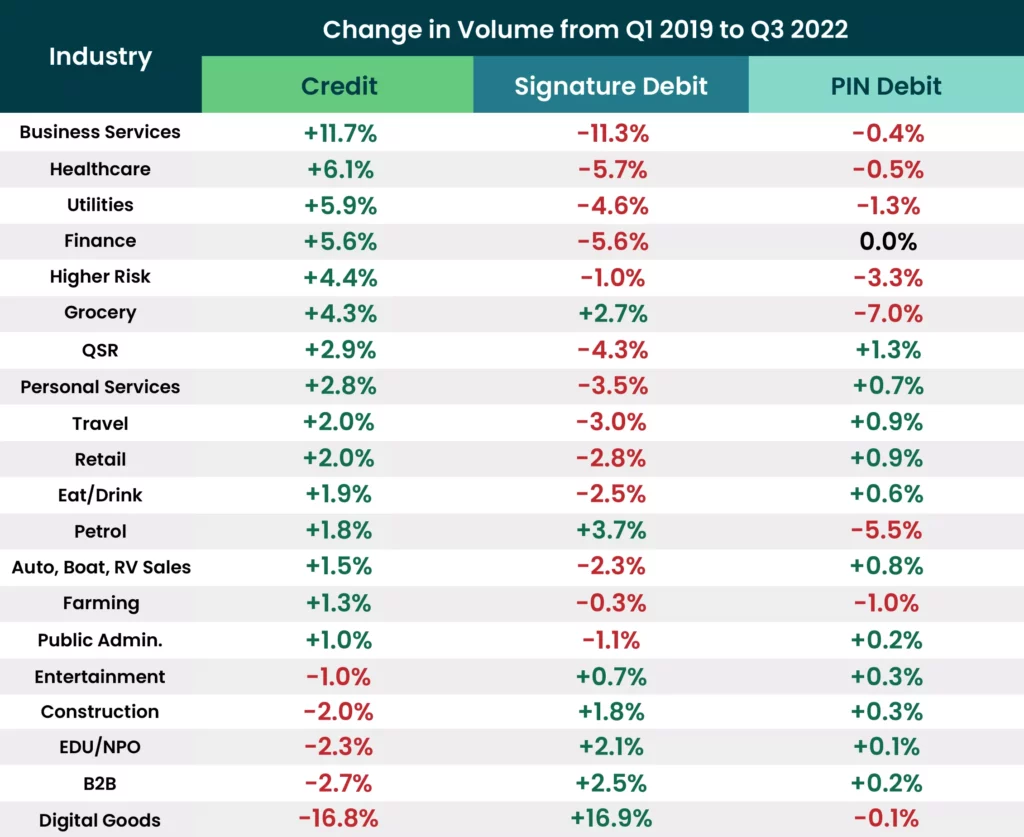

While the Mastercard/Visa payments volume data sets the stage, it does not tell the details of the story. Leveraging TSG’s AIM platform can help guide payments companies by providing a more granular look.

For example, the table sourced from AIM below shows the change in card volume from Q1 2019 to Q3 2022. Business Services’ credit volume grew by 11.7% (think accountants and attorneys) while Digital Goods saw a drop in credit usage of 16.8%.

Despite shifts in the usage of debit and credit cards, there has been consistent growth in both volume and transactional counts, as evidenced by data from Visa and Mastercard’s quarterly results and TSG’s AIM platform. This growth was seen in the early stages of the pandemic and during the inflationary cycle that followed. Additionally, the rise in card-not-present transactions has contributed to the stability of the payments industry. Overall, the payments ecosystem continues to play a crucial role in supporting the global economy, maintaining its strength even in uncertain times.

Merchant Portfolio Takeaways

- The shift in credit/debit spending mix impacts the profitability of an acquiring portfolio due to the net spread differential between the transaction types

- Considering the recent shifts in credit & debit mix, along with associated relative spreads, acquirers need to understand the mix of models within their portfolio to forecast or influence revenue accurately

- Merchants priced with a bundled, tiered, or flat rate model are exposed to margin compression when credit mix increases

Contact us to learn how AIM can provide the data granularity you need to succeed.